There are several reasons why you may consider transferring your Individual Savings Account (ISA) such as finding a better rate of interest or bringing your money together so it's easier to manage.

In this guide, we’ve put together some helpful information and explained how you can transfer your existing ISA to Close Brothers Savings.

What is an ISA transfer?

An ISA transfer is when you move your ISA savings from one provider to another. This can be done at any time and includes funds built up in previous tax years and/or money invested in the current tax year. Transfers can be made to a different type of ISA or to the same type of ISA.

To ensure that your ISA savings allowance remains tax free*, an ISA transfer must be arranged by your existing ISA provider and not carried out yourself.

*Interest on ISAs is paid tax-free, meaning without tax deducted. Tax treatment is dependent on individual circumstances, which may be subject to change in the future.

How do I transfer my existing ISA to Close Brothers Savings?

Open a new Cash ISA with Close Brothers Savings

If you’re opening a new Cash ISA with Close Brothers Savings, you can start the transfer process as part of your online application.

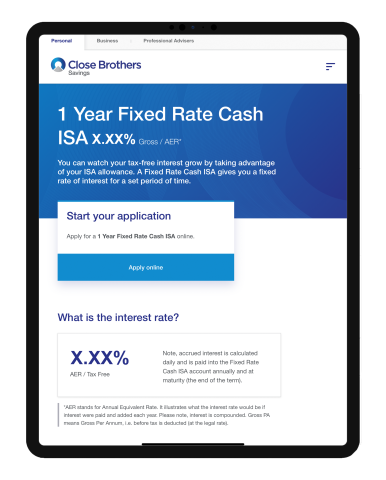

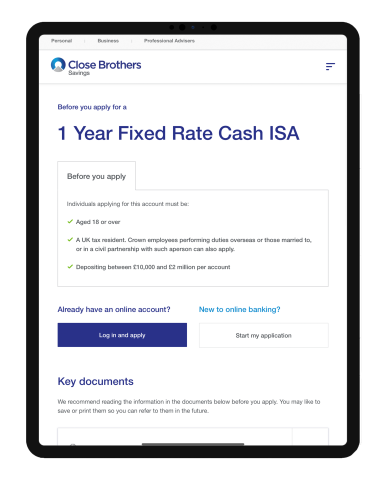

Step one | Step two |

Image

| Image

|

| Once you have chosen the product you like, click ‘Apply online’ | After reading the key documents, if you’re an existing customer click ‘Login and apply’, if you’re a new customer click ‘ Start my application’. |

You will then be asked to confirm your personal details such as your name, address, national insurance number and nominated bank account. Please fill in this information and then select continue.

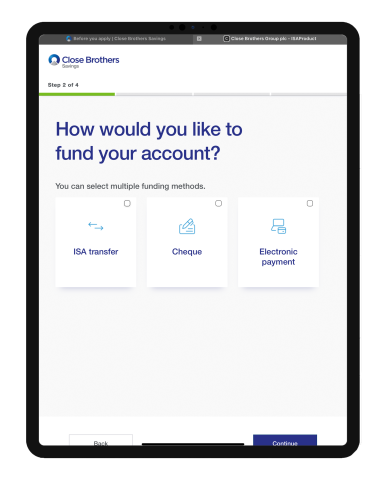

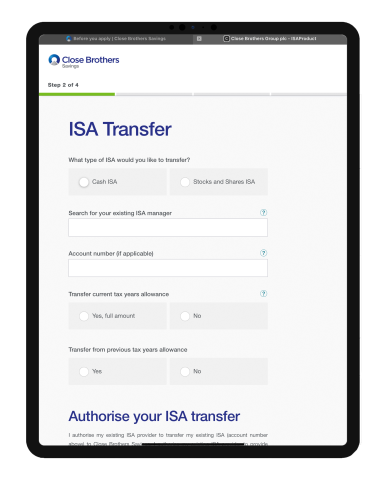

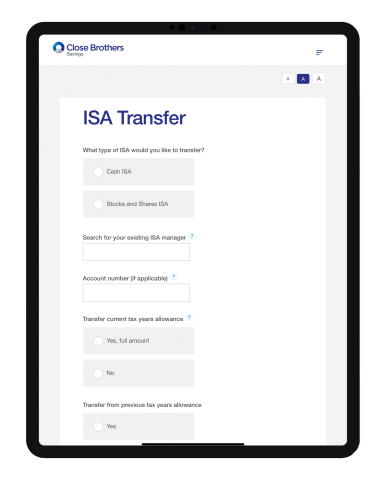

Step three | Step four |

Image

| Image

|

| When you come to the funding page, please select ‘ISA transfer’. If you would like to also transfer additional funds (within your ISA allowance) not currently held within an ISA you will be able to do so once the account has been opened. | Please enter the details for your existing ISA and how much you wish to deposit. Please note that the minimum deposit for our Fixed Rate Cash ISA is £10,000. |

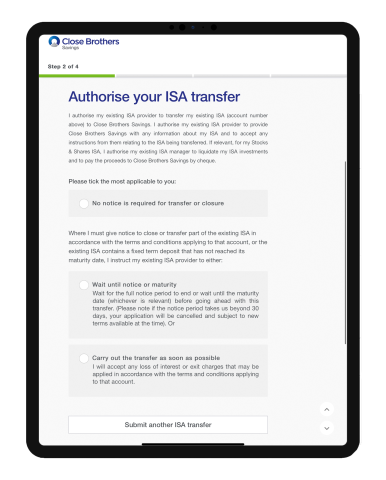

Step five | |

Image

| |

| Once you have entered the details for your existing ISA you will then have the option to submit another ISA transfer or to continue. |

Once you have completed your application, our Customer Operations team will take it from here.

Top-up a Cash ISA with Close Brothers Savings

If you’re looking to top-up your Cash ISA with funds from another provider, you can login to your online account and navigate to the funding tab to start the process.

Please note we must receive your deposit and/or ISA transfer instructions within 10 calendar days of receiving your completed application form. After this funding window no further funds can be added to your account.

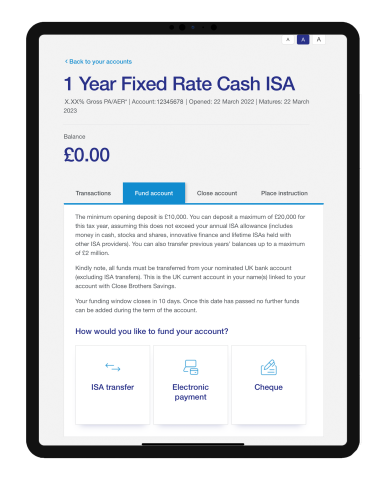

Step one | Step two |

Image

| Image

|

| Once you have logged in to your online account with Close Brothers Savings, navigate to your Cash ISA account and select the ‘Fund account’ tab. | Please enter the details for your existing ISA and how much you wish to deposit. Please note that the minimum deposit for our Fixed Rate Cash ISA is £10,000. |

Once you have completed these steps, our Customer Operations team will take it from here.

Alternatively, you can download our transfer authority form and return it to us at: Close Brothers Savings, 10 Crown Place, London, EC2A 4FT.

Please note, you will need to fill out one form per ISA transfer.

How much can I transfer into a Close Brothers Savings Fixed Rate Cash ISA?

While the maximum balance for our Fixed Rate Cash ISA is £2 million, for the current tax year, the maximum you can deposit is £20,000.

If you have accrued a balance over £20,000 in previous tax years, then you will be able to transfer all or part of this amount.

Are there any restrictions with an ISA transfer?

Please note, Close Brothers Savings only accept transfers in from other Cash ISAs or Stocks and Shares ISAs.

For money you have invested in previous years, you can choose to transfer all or part of your savings. If you would like to transfer money you’ve invested in an ISA during the current year, you must transfer all of it (the UK tax year runs from 06 April to the following 05 April).

Once your 10 day funding window has closed with our Fixed Rate Cash ISAs, no further funds can be added to your account.

Please check with your existing provider for any restrictions they may have on transferring ISAs.

How to long does it take to process an ISA transfer?

To transfer a Cash ISA from one provider to another it can take up to 15 working days. For the transfer of a Stocks and Shares ISA it can take up to 30 calendar days.

If you would like to receive an update on your ISA transfer, please contact your existing ISA provider.